As an investor, you always want and expect your investments to grow in value. Sometimes however, they just don’t. When this happens, there are still ways to turn a market downturn into a positive. For example, you can purchase high quality investments at discounted prices. Another example is to use an advanced investment strategy called “Tax Loss Harvesting” or “Tax Loss Selling”. For some investors, especially those in the high tax brackets, tax gain/loss harvesting is the single most important tool for reducing taxes now and in the future. When properly applied, it can save you taxes and help to diversify a portfolio in ways that may not have been considered. The losses harvested can be used to offset taxable gains within the portfolio and in some cases can be used to offset ordinary income. Here is how tax loss harvesting works: When you sell an investment in a taxable account for less than you paid at purchase, you create a capital loss for tax purposes. This loss can be used in two ways: offsetting investment capital gains and/or reducing ordinary taxable income. Under the current tax law, if your loss is more than your gain, it can reduce earned income up to $3,000 per year ($1,500 for anyone who’s married and filing taxes separately). But it gets even better in the event you have reported losses of more than $3,000, because the remaining losses can be carried forward into future tax years. For example, after reviewing your portfolio you decide to sell an investment locking in a $5,000 capital gain. This taxable event can be offset by selling one or more investments totaling a $5,000 capital loss, which in this example could save you as much as $1,980 in taxes if you’re in the top 39.6% tax bracket. When done properly and when the portfolio is evaluated frequently for tax loss harvesting opportunities, it can add up to big tax savings for some investors. Now let’s evaluate the previous example, but harvest a $9,000 tax loss. The $5,000 offset to the capital gains would remain unaffected, but you would now be left with $4,000 in net capital losses. You would then use it to reduce taxable income up to the IRS limit of $3,000 in the current year. The remaining $1,000 capital loss is then carried forward to the future tax year. The concept is a simple one to understand but using it in the real world can be tricky. The IRS has what’s called the “Wash Sale Rule” which prevents you from selling and purchasing the same investment within 30 days. Also, long-term losses are first used to offset long-term gains and then short-term gains; short-term losses are used to offset short-term gains and can then be used against long-term gains. You are encouraged to work closely with your tax professional. Many financial advisors don’t even discuss tax loss harvesting with clients that would benefit from the strategy. Many others only talk about harvesting losses at years end before taxes are due and paid. That’s fine for some clients, but it’s more advantageous to be looking for tax loss opportunities throughout the entire year, especially in a year when the markets are volatile. It’s possible tax-loss harvesting opportunities will arise early in the year, only to disappear by years end. If you’re in a tax bracket of 25% or higher, and this is the first time that you are hearing about this investment strategy, I highly encourage you to call me. We cater to investors who are tax conscious and desire a high level of customer service. For a complementary consultation to see if tax loss harvesting might be an added benefit for your particular situation, give me a call.

Option 1: Leave your money in the current plan.

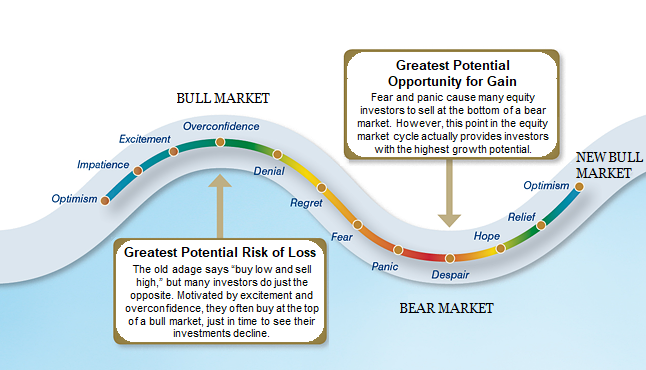

This isn’t the best option for most investors, because once your job has been terminated, so have your benefits that come from participating in a Profit Sharing Plan or similar retirement plan. No longer can you contribute, or benefit from employer matching. Often times out-of-sight means out-of-mind, not the management you want for your most valuable retirement asset. In addition, the annual fees being charged can be more expensive than options 2 or 3 listed below. Consult a financial professional for more questions about this option. Option 2: “Roll it over” into a new employment plan at your current employer. For most investors, this is a better option than option 1; however, it continues to come at a cost for the investor. The rollover amount cannot participate in employer matching, and the fees charged at the new 401(k) plan might cost more than options 1 or 3 shown here. In addition, most 401(k) plans offer only about 30 investment choices and limited customer services in their plan. Because it isn’t uncommon for rollovers to be a substantial amount of money, you might not get the diversification or customer service needed for such a large retirement nest egg. Option 3: “Rollover” your old plan into a Traditional IRA account with no tax consequences. For most investors this is the best option because outside investment firms are much more completive than most employer sponsored plans. By having a traditional IRA you have many more and better investment options made available to you, not just the 30 or so offered by your current plan. In addition, retirement plan costs are often cheaper, which results in a better bottom line for your portfolio. Customer service depends greatly on the firm you choose, so make sure to find a financial professional and firm you trust and want to work diligently with. When you’re ready to move your Profit Sharing Plan or similar retirement plan, I encourage you to contact me. As an independent financial advisor with no corporate ties or sales quotas, I will take the time to educate you on your personal options. My customer service is impeccable as you will come to find during our relationship. It’s your money; make sure it’s at the right place! Investors have a real knack for piling into investments at the top and selling at the bottom. Every investor knows that this is counterintuitive to the "buy low and sell high" philosophy. This investor behavior has been well documented, and there are numerous theories that attempt to explain the regret and overreaction that buyers and sellers experience when it comes to their money and the potential gains and losses on that money. This was best illustrated in the economic white paper written by Dr. Daniel Kahneman, the only psychologist to ever win a Nobel Prize for Economics. He suggested that "when faced with uncertainty, investors tend to make decisions based on their emotions and subjective experiences, not on logic or objective reality. As a result, investors can easily make the wrong decision for their individual situation." As a financial professional I find it intriguing to watch investor sentiment change with the markets. What I find even more fascinating is how investors regularly have a follow the herd mentality even though they know they shouldn’t. Many investors sold their investments at the bottom of the financial meltdown saying that they would "never invest in stocks again". They then watched as the Dow Jones went from 6,626 to 12,810 within a two-year period. During that time it never felt good to invest. Many of those investors then said things like "well, maybe never buying stocks is silly, but I’m still not ready to invest." They then watched the markets go from 12,810 to 15,600 in the summer of 2013. It was only then that many investors began to feel comfortable investing in stocks again. Sadly, without realizing it, the investor is stuck in the emotional investment cycle described in Dr. Kahneman’s research.

This theory showing that many market participants buy at the top and sell at the bottom has proved to be true based on historical money flow analysis. Money flow analysis looks at the net flows of funds for mutual funds. Over a period from 1988 through 2009, money flow analysis showed that when the market hit its peak or valley, money flows were at its highest levels. Net inflows peaked at or near the market top while net outflows peaked at market bottoms and continued to be negative even as the market moved into an upward trend. Sadly, investing without emotion is easier said than done, especially because uncertainty rules the market and the media. Evidence suggests that most investors are emotional and maximize money flows at the wrong times. This is a surefire way to reduce potential returns. There are many different strategies that can be used to help investors control and harness their emotions as it relates to investing. These strategies can eliminate the emotional response to investing and should produce returns that are significantly greater than those indicated by the typical investor responding to the markets. Many of these tactics however require the leadership of a financial advisor. My greatest advice to investors who tend to invest based on emotion, and most do, is to find an advisor they trust and are comfortable working with. Visit with them about the tactics they use, and make sure the two of you can develop a plan you will be happy with in both bull and bear markets. In closing, I want to make it very clear that there are always good investments to buy somewhere. As I write this, the Dow Jones is at almost 33,000 and interest rates have been rising rapidly off their radically historical lows of 2021 with no immediate rest in site. Many investors are finding themselves now buying stocks and bonds at a time when the risk is very high. Perhaps the reason why is because these are the two most commonly discussed investment asset classes, but they are only two of 16 different asset classes that investor can participate in. It has been well documented that by using all 16 asset classes to find true diversification, investors can lower risk and increase potential returns. If you would like to know more about what I am doing for my clients to increase returns and lower risk during a period when most investors are starting to chase the herd, please give me a call. *Chad Schiel is an independent financial planner providing services in Orange County California. As an independent financial advisor free from sales quotas and corporate agendas, he takes the time needed in providing his clients with the best customer service, investments and solutions found anywhere. Are you working with a service provider like Schiel Wealth Management? Perhaps it’s time you start. Disclosure: Investors should be aware that investing based upon a strategy or strategies does not assure a profit or guarantee against loss.

This was our biggest event to date with over 120 in attendance as we packed and shipped 28,512 meals to Southeast Africa. Complete with live music, killer taco caterer, and baloonagami for the kids as we also celebrated over 100,000 meals packed since October 2019! To God be the glory!

"For I was hungry, and you fed me. I was thirsty, and you gave me a drink. I was a stranger, and you invited me into your home." ~Matthew 25:35

1. Consider lowering your end of the year tax liability. Unlike Traditional or Roth IRA’s which only allow you to contribute a maximum of $6,500 depending on your age, Solo 401k plans can allow you to invest up to $62,000 depending on your income and age. This is something that you should talk with your CPA and Financial Advisor about, because it is a wonderful way of reducing your tax liability while working to build long term wealth. 2. Gives you more cash flow liquidity options before the retirement age of 59½.

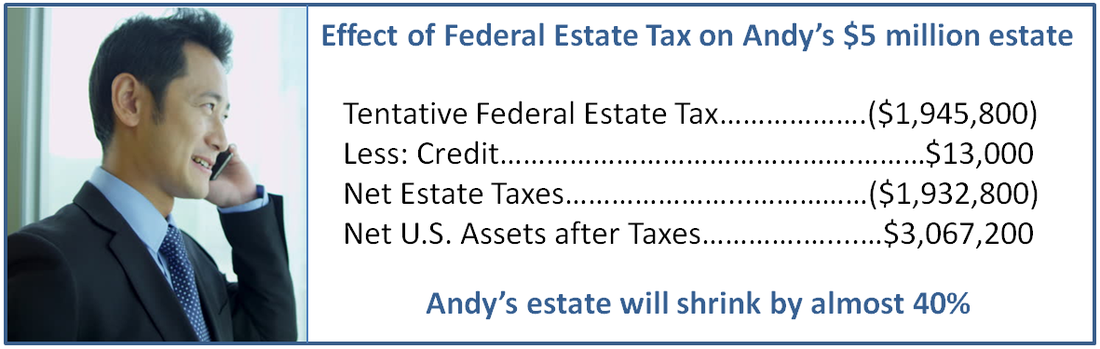

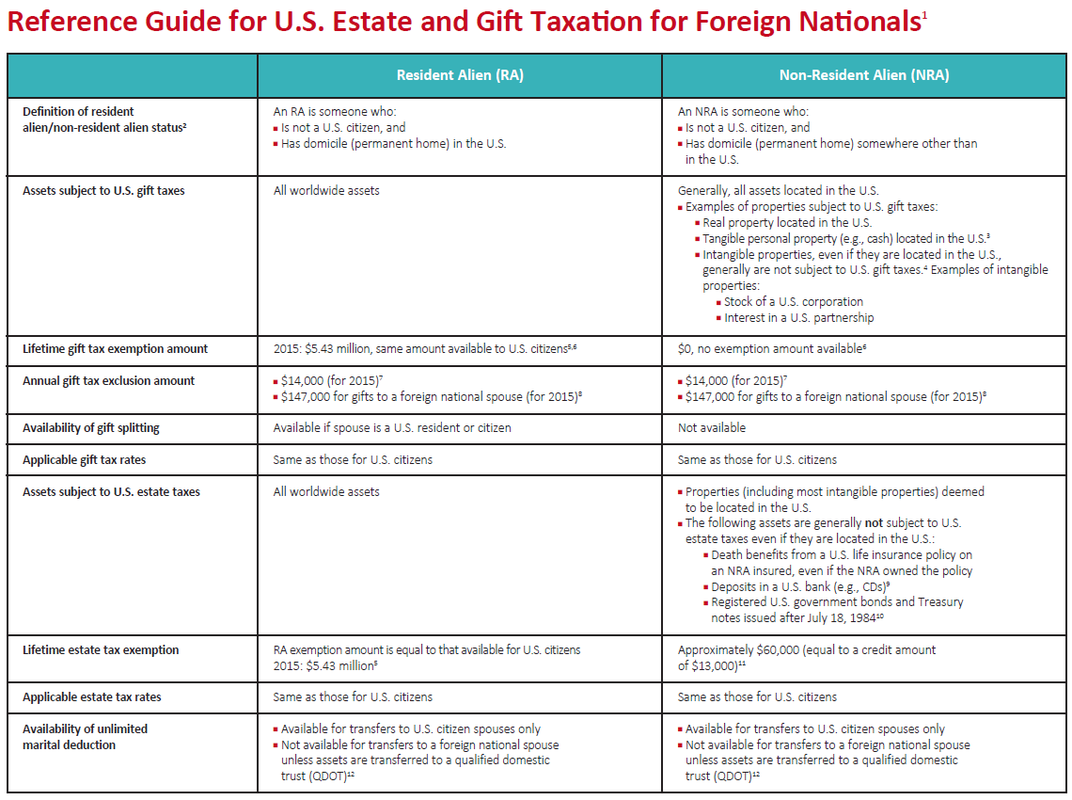

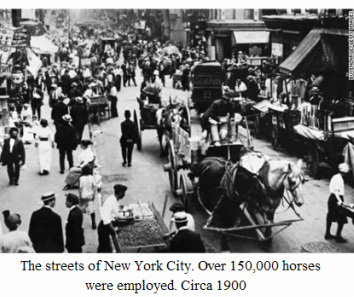

Let’s face it; sometimes as small business owners we have really great months and really slow ones. Cash flow and keeping the company lights on is something that is top-of-mind for all small business owners, but this shouldn’t prevent you from also saving and investing for retirement. Solo 401k plans allow business owners to borrow up to $50,000 or 50% of the account balance from their retirement account without penalty or consequence. The balance borrowed is issued to you with an interest rate that is far lower than other forms of credit, or small business loans. In more ways than one, you can become your businesses lending institution during periods of slow cash flow and times of uncertainty. Think about how that could help with liquidity during times of a nationwide credit crunch like the ones we have seen in the past! Best of all, your contribution balance stays invested and growing as long as you make payments back to the borrowed amount. 3. As the business owner, you make the choice when you pay the taxes. Now or Later? No one likes paying more in taxes than they have to. Unlike some retirement accounts, Solo 401k accounts allow you to make the decision pertaining to when you pay your taxes on the amount invested. You can pay your taxes now and invest using a Roth IRA strategy, meaning you never pay taxes again on balance of the account. Or you can invest in a tax deferred account, allowing you to take advantage of tax savings now in your current tax year. Speak with your CPA and me before making a decision. When you’re ready to talk about a Solo 401k or similar retirement plan, I encourage you to contact me. As an independent financial advisor with no corporate ties or sales quotas, I will take the time to educate you on your personal options. My customer service is impeccable as you will come to find during our relationship. It’s your money; make sure it’s at the right place!  Here in Orange County, there are thousands of financial advisors and wealth managers. So what is it that sets me apart from the competition and has clients raving about my services and solutions? Here are the top seven reasons… Better Investment Diversification: Most banks and brokerage firms build portfolios where 60% is invested in stocks and 40% in bonds. This however isn’t true diversification. By adding other types of investments you can often lower risk while still achieving healthy returns. Leadership and Service from the Front: What good is a “reactive” financial advisor? That’s not leadership! When you work with me, you get a proactive portfolio manager. Cutting Edge Software and Reports: Using the most current software available, I develop and execute investment strategies. I also create a financial plan for reaching your goals. Portfolio Personalization: I am dedicated to you and your personal investment goals. I understand that you are a unique person with custom needs and desires when it comes to your financial goals. I don’t have a one size fits all mentality. Investment Options: Access to over 5,000 mutual funds, exchange traded funds (ETF’s), real estate investment trusts (REIT’s), as well as stocks, bonds, commodities, and options. We also offer life and long term care insurance solutions. A Painless Transition from Your Old Investment Bank: It is surprisingly easy to make the move, don’t let today’s hesitation cost you tomorrow’s benefits. Fees and Commissions: If you think you may be paying too much for the services and investment advice you're receiving, then I would like to extend an invitation for a complementary portfolio review. It's important that fees and commissions are justifiable and not exorbitant. I feel confident that you will be comfortable and pleased with how I can help. *Chad Schiel is an independent financial planner providing services in Orange County California. As an independent financial advisor free from sales quotas and corporate agendas, he takes the time needed in providing his clients with the best customer service, investments and solutions found anywhere. Are you working with a service provider like Schiel Wealth Management? Perhaps it’s time you start. Disclosure: Diversification does not guarantee profit or preservation of your principle investment. It is important for investors to understand the contents of their portfolios and the risks associated with those investments. “Alternative Investments” are not appropriate for some investors and you should consult with your financial advisor to ensure that a better investment option for your personal situation doesn’t exist.  The year was 1880 when people in New York City as well as other major metropolitan areas realized that they had a really big problem on their hands… Horse manure! During that time, the city of New York hired 150,000 horses, and this doesn’t take into consideration all of the horses used for private transportation. A horse will “displace” 22lbs of horse manure every single day. This equates to over 3 million pounds of horse manure daily in New York City! Not to mention over 40,000 daily gallons of urine and 15,000 dead horses annually. It was becoming such a big problem that in the year 1898, big cities from around the globe held the first international urban planning conference to try and address the problem. For three days they talked and couldn’t come up with a solution, but an attending economist calculated that if something wasn’t done, the city of New York would be buried under 30 feet of horse manure by 1920. During this time, Henry Ford was quoted saying “The biggest problem with my customers is that they only extrapolate the present”. He went on to say that what his customers regularly asked for was a faster horse in the year 1912. During that time, people simply didn’t understand that the automobile would be a better mode of transportation. By the year 1913, automobiles outnumbered horses and by 1917 automobiles replaced the last horse employed by the city of New York. I tell this amazing, stinky story to remind people that they must look to the future to be successful investors. As I write this article, the Dow Jones is at almost 26,000 and reflects the longest continuous bull market without a 20% correction since the crash of 1929. People have become fascinated by this bull market and some investors are just now getting off the sidelines and starting to participate in the Stock Market. This behavior, although predictable, still manages to amaze me. Investors continue to have a real knack for piling into investments at the top and selling at the bottom. This behavior has been well documented and proven by Psychologist Daniel Kahneman, the only non-economist to ever win a Nobel Prize for his work in Economics. We have no idea how or when this current bull market that began in 2009 might end, but at some point it will correct. This is the time to consider selling some of your stock holdings and moving to assets that haven’t yet peeked in price - like sector specific commercial real estate. It’s time to have those difficult conversations with your financial advisor to find out what their plan is for the future of your investment portfolio. It might even be time to change advisors. I will leave you with one final quote from the respected investor Warren Buffett who said “Chains of habit are too light to be felt until they are too heavy to be broken”.  As a Foreign National, whether a Resident Alien or a Non-Resident Alien, who has assets in the United States, you cannot take advantage of certain tax provisions available to U.S. Citizens. Therefore, without proper planning, your estate may owe a large U.S. estate tax bill, which may shrink your estate and reduce the legacy that you’re able to leave to your family. In order to illustrate the impact that U.S. estate taxes can have on your family, consider the example of Andy Li. He is a Hong Kong national and resident with $5 million in real estate and other investments in the United States. If Andy does no planning, his family stands to lose over one-third of the value of his estate to taxes. For example, if he dies this year, the estate tax law provides for a 40% top tax rate. The net estate tax due on his $5 million U.S. estate is $1,932,800. This means that instead of leaving the entire $5 million estate to his family, they would only inherit $3,067,200. U.S. estate taxes will decrease Andy’s U.S. estate by almost 40%. As a Foreign National you fall into one of two categories – Residential Alien or Non-Residential Alien, and both are taxed differently by the United States. For example (unlike that of Non-Resident Alien Andy Li above), as a Residential Alien all worldwide assets are taxed after a $5.34 million estate tax exemption. To see specifics of exemptions, deductions, and taxes please see the chart titled “Reference Guide for U.S. Estate and Gift Taxation for Foreign Nationals” at the end of this article. The greatest gift you can give your family is simply taking some time to sit with a financial planner who specializes in maximizing your estate and legacy. Taking certain steps to maximize your estate is often the key difference for your loved ones ability to continue generating wealth and honoring your legacy. If you’re concerned about your particular situation and would like to discuss your options, then I encourage you to contact me for a complementary review. Let me share some other key information with you so that you can make an informed decision to keep your hard earned wealth within your family. *Chad Schiel is an independent financial planner providing services in Orange County California. As an independent financial advisor free from sales quotas and corporate agendas, he takes the time needed in providing his clients with the best customer service, suitable investments and solutions found anywhere. Are you working with a service provider like Schiel Wealth Management? Perhaps it’s time you start.

|

AuthorChad William Schiel |

||||||||||

Phone: (949) 388-4455 | 30448 Rancho Viejo Rd. Suite 180, San Juan Capistrano, CA 92675

|

Information provided in news feeds above are from sources believed to be reliable however we cannot guarantee or represent that it is accurate or complete. Because situations vary, any information provided on this site is not intended to indicate suitability for any particular investor. Hyperlinks are provided as a courtesy. When you link to a 3rd party website you are leaving our site, assuming all responsibility for your use at these sites. Contact this office for more information.

|

Chad Schiel is a Registered Representative offering securities and advisory services through Independent Financial Group, LLC, a registered broker-dealer and investment advisor. Member FINRA and SIPC. Office of Supervisory Jurisdiction: 12671 High Bluff Drive, Suite 200, San Diego, CA 92130. Independent Financial Group and Schiel Wealth Management are not affiliated entities. California Insurance License #0G82354. Licensed to sell securities in the following states: AZ, CA, CO, ID, IN, MD, MN, MT, NC, NV, OK, OR, PA, SC, TX, UT, VA, WA.

~Check the background of this firm on FINRA’s BrokerCheck at http://brokercheck.finra.org/ |