Management: American Funds, Franklin Templeton, Pimco, and Phillips Edison are all great managers just to name a few, but not all managers are created equally. Make sure that your investment managers have your best interests in mind, and make sure that they charge a fee suitable for the services offered. Ultimately a management fee directly affects your bottom line, so make sure that your investment manager is good at selecting investments, minimizing risk, and isn’t charging too much.

Structure: There are lots of ways to bundle or structure investments. The more complex the structure, the more costly it becomes to you the investor. An annuity can be a great example of an expensive structured investment. For example, most annuities bundle mutual funds, which bundle stocks and bonds. Often times these annuities come with special guarantees or riders which can be very expensive. I’m not saying that annuities aren’t worth owning. However be careful that they or any other investments you buy don’t have an overly high cost structure. There are tens of thousands of mutual funds, stocks, and other investments available to you. As you can imagine, it becomes a very cumbersome task to evaluate these funds and know who to do business with. This is where a personal financial planner comes into play. I specialize in creating suitable investment strategies by first learning about your personal goals, risk tolerances, and then building a customized portfolio. If you have any other questions or would like to have a complementary portfolio review to make sure that PMS exists in your portfolio, just give me a call.

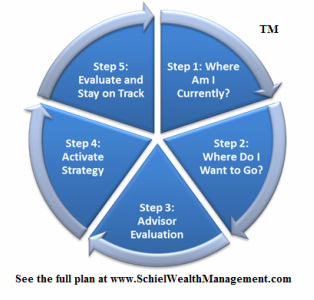

Step 1: Where Am I Now?

Before you can determine where you want to go, you first need to honestly determine your current financial situation. Sharing information such as a list of monthly expenses, last year's tax return, retirement plan statements, brokerage, bank and other financial statements will help me understand and provide an overview of your current situation. Step 2: Where Do I Want to Go? After determining where you are today, the next step is to set tailored goals personalized to... • Preparing for Retirement • Education Funding • Living in Retirement • Planning Your Estate & Inheritances Step 3: Advisor Evaluation Using state of the art software, I create a personalized evaluation based on your current situation, future income requirements and comfort level with risk. We work together to create and implement strategies that can help you achieve your dreams and objectives. Step 4: Activate Strategy My investment philosophy focuses on building a diversified portfolio containing quality investments that provide for your established goals. I use a variety of asset allocation tools to keep your investments and risk at a level you are comfortable with. As your financial advisor, I can help you select the appropriate mix of investments to help your goals become a reality while keeping your risk as low as possible. Step 5: Evaluate and Stay on Track Meeting annually and talking frequently can help ensure that you stay on track. If any of your goals or circumstances change, we can make appropriate changes that address the evolving situation. |

AuthorChad William Schiel |

||||||||||||

Phone: (949) 388-4455 | 30448 Rancho Viejo Rd. Suite 180, San Juan Capistrano, CA 92675

|

Information provided in news feeds above are from sources believed to be reliable however we cannot guarantee or represent that it is accurate or complete. Because situations vary, any information provided on this site is not intended to indicate suitability for any particular investor. Hyperlinks are provided as a courtesy. When you link to a 3rd party website you are leaving our site, assuming all responsibility for your use at these sites. Contact this office for more information.

|

Chad Schiel is a Registered Representative offering securities and advisory services through Independent Financial Group, LLC, a registered broker-dealer and investment advisor. Member FINRA and SIPC. Office of Supervisory Jurisdiction: 12671 High Bluff Drive, Suite 200, San Diego, CA 92130. Independent Financial Group and Schiel Wealth Management are not affiliated entities. California Insurance License #0G82354. Licensed to sell securities in the following states: AZ, CA, CO, ID, IN, MD, MN, MT, NC, NV, OK, OR, PA, SC, TX, UT, VA, WA.

~Check the background of this firm on FINRA’s BrokerCheck at http://brokercheck.finra.org/ |