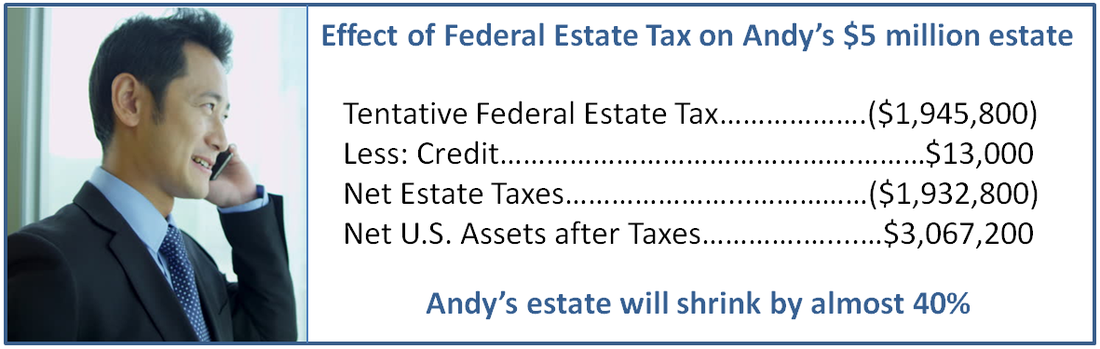

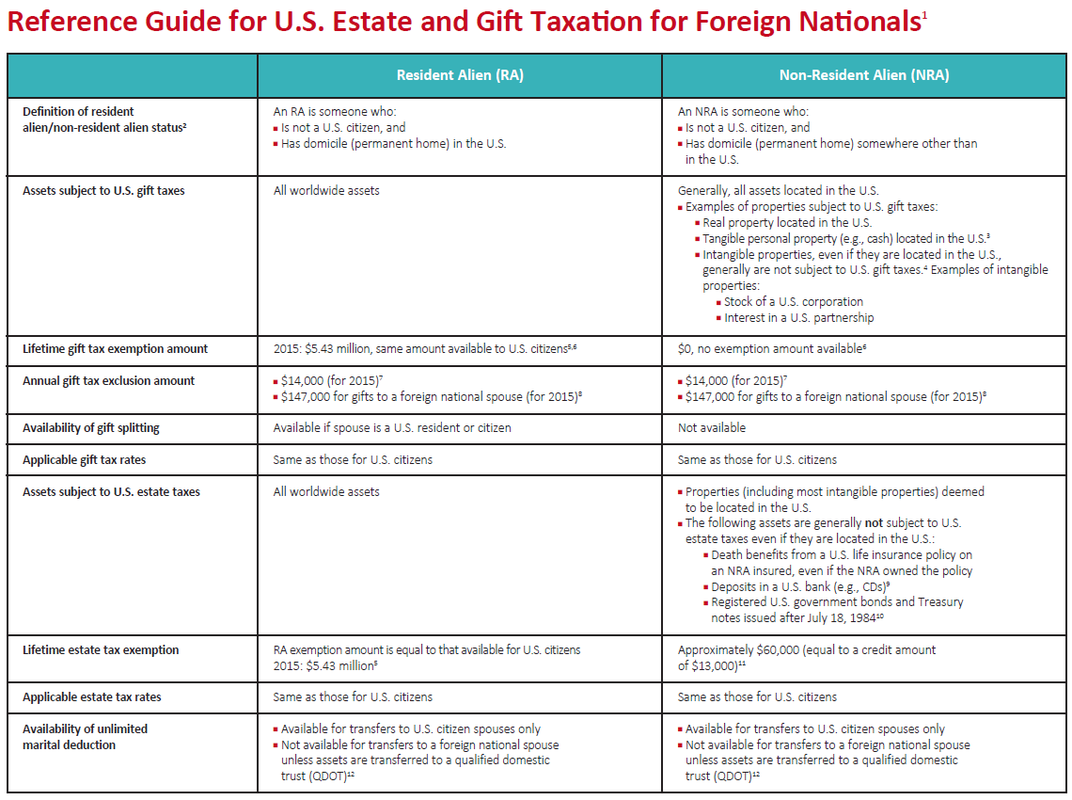

As a Foreign National, whether a Resident Alien or a Non-Resident Alien, who has assets in the United States, you cannot take advantage of certain tax provisions available to U.S. Citizens. Therefore, without proper planning, your estate may owe a large U.S. estate tax bill, which may shrink your estate and reduce the legacy that you’re able to leave to your family. In order to illustrate the impact that U.S. estate taxes can have on your family, consider the example of Andy Li. He is a Hong Kong national and resident with $5 million in real estate and other investments in the United States. If Andy does no planning, his family stands to lose over one-third of the value of his estate to taxes. For example, if he dies this year, the estate tax law provides for a 40% top tax rate. The net estate tax due on his $5 million U.S. estate is $1,932,800. This means that instead of leaving the entire $5 million estate to his family, they would only inherit $3,067,200. U.S. estate taxes will decrease Andy’s U.S. estate by almost 40%. As a Foreign National you fall into one of two categories – Residential Alien or Non-Residential Alien, and both are taxed differently by the United States. For example (unlike that of Non-Resident Alien Andy Li above), as a Residential Alien all worldwide assets are taxed after a $5.34 million estate tax exemption. To see specifics of exemptions, deductions, and taxes please see the chart titled “Reference Guide for U.S. Estate and Gift Taxation for Foreign Nationals” at the end of this article. The greatest gift you can give your family is simply taking some time to sit with a financial planner who specializes in maximizing your estate and legacy. Taking certain steps to maximize your estate is often the key difference for your loved ones ability to continue generating wealth and honoring your legacy. If you’re concerned about your particular situation and would like to discuss your options, then I encourage you to contact me for a complementary review. Let me share some other key information with you so that you can make an informed decision to keep your hard earned wealth within your family. *Chad Schiel is an independent financial planner providing services in Orange County California. As an independent financial advisor free from sales quotas and corporate agendas, he takes the time needed in providing his clients with the best customer service, suitable investments and solutions found anywhere. Are you working with a service provider like Schiel Wealth Management? Perhaps it’s time you start.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorChad William Schiel |

Phone: (949) 388-4455 | 30448 Rancho Viejo Rd. Suite 180, San Juan Capistrano, CA 92675

|

Information provided in news feeds above are from sources believed to be reliable however we cannot guarantee or represent that it is accurate or complete. Because situations vary, any information provided on this site is not intended to indicate suitability for any particular investor. Hyperlinks are provided as a courtesy. When you link to a 3rd party website you are leaving our site, assuming all responsibility for your use at these sites. Contact this office for more information.

|

Chad Schiel is a Registered Representative offering securities and advisory services through Independent Financial Group, LLC, a registered broker-dealer and investment advisor. Member FINRA and SIPC. Office of Supervisory Jurisdiction: 12671 High Bluff Drive, Suite 200, San Diego, CA 92130. Independent Financial Group and Schiel Wealth Management are not affiliated entities. California Insurance License #0G82354. Licensed to sell securities in the following states: AZ, CA, CO, ID, IN, MD, MN, MT, NC, NV, OK, OR, PA, SC, TX, UT, VA, WA.

~Check the background of this firm on FINRA’s BrokerCheck at http://brokercheck.finra.org/ |