|

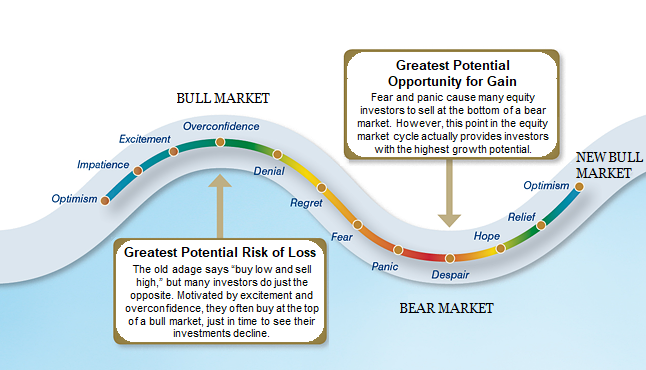

Investors have a real knack for piling into investments at the top and selling at the bottom. Every investor knows that this is counterintuitive to the "buy low and sell high" philosophy. This investor behavior has been well documented, and there are numerous theories that attempt to explain the regret and overreaction that buyers and sellers experience when it comes to their money and the potential gains and losses on that money. This was best illustrated in the economic white paper written by Dr. Daniel Kahneman, the only psychologist to ever win a Nobel Prize for Economics. He suggested that "when faced with uncertainty, investors tend to make decisions based on their emotions and subjective experiences, not on logic or objective reality. As a result, investors can easily make the wrong decision for their individual situation." As a financial professional I find it intriguing to watch investor sentiment change with the markets. What I find even more fascinating is how investors regularly have a follow the herd mentality even though they know they shouldn’t. Many investors sold their investments at the bottom of the financial meltdown saying that they would "never invest in stocks again". They then watched as the Dow Jones went from 6,626 to 12,810 within a two-year period. During that time it never felt good to invest. Many of those investors then said things like "well, maybe never buying stocks is silly, but I’m still not ready to invest." They then watched the markets go from 12,810 to 15,600 in the summer of 2013. It was only then that many investors began to feel comfortable investing in stocks again. Sadly, without realizing it, the investor is stuck in the emotional investment cycle described in Dr. Kahneman’s research.

This theory showing that many market participants buy at the top and sell at the bottom has proved to be true based on historical money flow analysis. Money flow analysis looks at the net flows of funds for mutual funds. Over a period from 1988 through 2009, money flow analysis showed that when the market hit its peak or valley, money flows were at its highest levels. Net inflows peaked at or near the market top while net outflows peaked at market bottoms and continued to be negative even as the market moved into an upward trend. Sadly, investing without emotion is easier said than done, especially because uncertainty rules the market and the media. Evidence suggests that most investors are emotional and maximize money flows at the wrong times. This is a surefire way to reduce potential returns. There are many different strategies that can be used to help investors control and harness their emotions as it relates to investing. These strategies can eliminate the emotional response to investing and should produce returns that are significantly greater than those indicated by the typical investor responding to the markets. Many of these tactics however require the leadership of a financial advisor. My greatest advice to investors who tend to invest based on emotion, and most do, is to find an advisor they trust and are comfortable working with. Visit with them about the tactics they use, and make sure the two of you can develop a plan you will be happy with in both bull and bear markets. In closing, I want to make it very clear that there are always good investments to buy somewhere. As I write this, the Dow Jones is at almost 33,000 and interest rates have been rising rapidly off their radically historical lows of 2021 with no immediate rest in site. Many investors are finding themselves now buying stocks and bonds at a time when the risk is very high. Perhaps the reason why is because these are the two most commonly discussed investment asset classes, but they are only two of 16 different asset classes that investor can participate in. It has been well documented that by using all 16 asset classes to find true diversification, investors can lower risk and increase potential returns. If you would like to know more about what I am doing for my clients to increase returns and lower risk during a period when most investors are starting to chase the herd, please give me a call. *Chad Schiel is an independent financial planner providing services in Orange County California. As an independent financial advisor free from sales quotas and corporate agendas, he takes the time needed in providing his clients with the best customer service, investments and solutions found anywhere. Are you working with a service provider like Schiel Wealth Management? Perhaps it’s time you start. Disclosure: Investors should be aware that investing based upon a strategy or strategies does not assure a profit or guarantee against loss. Comments are closed.

|

AuthorChad William Schiel |

Phone: (949) 388-4455 | 30448 Rancho Viejo Rd. Suite 180, San Juan Capistrano, CA 92675

|

Information provided in news feeds above are from sources believed to be reliable however we cannot guarantee or represent that it is accurate or complete. Because situations vary, any information provided on this site is not intended to indicate suitability for any particular investor. Hyperlinks are provided as a courtesy. When you link to a 3rd party website you are leaving our site, assuming all responsibility for your use at these sites. Contact this office for more information.

|

Chad Schiel is a Registered Representative offering securities and advisory services through Independent Financial Group, LLC, a registered broker-dealer and investment advisor. Member FINRA and SIPC. Office of Supervisory Jurisdiction: 12671 High Bluff Drive, Suite 200, San Diego, CA 92130. Independent Financial Group and Schiel Wealth Management are not affiliated entities. California Insurance License #0G82354. Licensed to sell securities in the following states: AZ, CA, CO, ID, IN, MD, MN, MT, NC, NV, OK, OR, PA, SC, TX, UT, VA, WA.

~Check the background of this firm on FINRA’s BrokerCheck at http://brokercheck.finra.org/ |