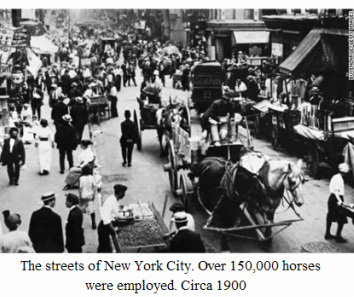

The year was 1880 when people in New York City as well as other major metropolitan areas realized that they had a really big problem on their hands… Horse manure! During that time, the city of New York hired 150,000 horses, and this doesn’t take into consideration all of the horses used for private transportation. A horse will “displace” 22lbs of horse manure every single day. This equates to over 3 million pounds of horse manure daily in New York City! Not to mention over 40,000 daily gallons of urine and 15,000 dead horses annually. It was becoming such a big problem that in the year 1898, big cities from around the globe held the first international urban planning conference to try and address the problem. For three days they talked and couldn’t come up with a solution, but an attending economist calculated that if something wasn’t done, the city of New York would be buried under 30 feet of horse manure by 1920. During this time, Henry Ford was quoted saying “The biggest problem with my customers is that they only extrapolate the present”. He went on to say that what his customers regularly asked for was a faster horse in the year 1912. During that time, people simply didn’t understand that the automobile would be a better mode of transportation. By the year 1913, automobiles outnumbered horses and by 1917 automobiles replaced the last horse employed by the city of New York. I tell this amazing, stinky story to remind people that they must look to the future to be successful investors. As I write this article, the Dow Jones is at almost 26,000 and reflects the longest continuous bull market without a 20% correction since the crash of 1929. People have become fascinated by this bull market and some investors are just now getting off the sidelines and starting to participate in the Stock Market. This behavior, although predictable, still manages to amaze me. Investors continue to have a real knack for piling into investments at the top and selling at the bottom. This behavior has been well documented and proven by Psychologist Daniel Kahneman, the only non-economist to ever win a Nobel Prize for his work in Economics. We have no idea how or when this current bull market that began in 2009 might end, but at some point it will correct. This is the time to consider selling some of your stock holdings and moving to assets that haven’t yet peeked in price - like sector specific commercial real estate. It’s time to have those difficult conversations with your financial advisor to find out what their plan is for the future of your investment portfolio. It might even be time to change advisors. I will leave you with one final quote from the respected investor Warren Buffett who said “Chains of habit are too light to be felt until they are too heavy to be broken”. Comments are closed.

|

AuthorChad William Schiel |

Phone: (949) 388-4455 | 30448 Rancho Viejo Rd. Suite 180, San Juan Capistrano, CA 92675

|

Information provided in news feeds above are from sources believed to be reliable however we cannot guarantee or represent that it is accurate or complete. Because situations vary, any information provided on this site is not intended to indicate suitability for any particular investor. Hyperlinks are provided as a courtesy. When you link to a 3rd party website you are leaving our site, assuming all responsibility for your use at these sites. Contact this office for more information.

|

Chad Schiel is a Registered Representative offering securities and advisory services through Independent Financial Group, LLC, a registered broker-dealer and investment advisor. Member FINRA and SIPC. Office of Supervisory Jurisdiction: 12671 High Bluff Drive, Suite 200, San Diego, CA 92130. Independent Financial Group and Schiel Wealth Management are not affiliated entities. California Insurance License #0G82354. Licensed to sell securities in the following states: AZ, CA, CO, ID, IN, MD, MN, MT, NC, NV, OK, OR, PA, SC, TX, UT, VA, WA.

~Check the background of this firm on FINRA’s BrokerCheck at http://brokercheck.finra.org/ |